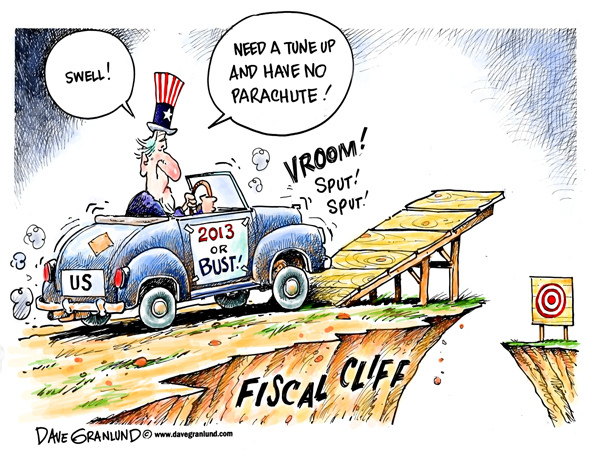

I was astounded recently to hear someone say they believe the talk of a “fiscal cliff” is artificial and not a legitimate threat. There is an artificial component to it in that government created it,but the threat is legitimate,and not only will it impact everyone of us in one way or another,even if an agreement is reached in Washington,but the cumulative economic impact could be significant.

There are several components to the so-called “fiscal cliff,” some of which are less widely known than others. Most people are aware that the present six income brackets taxed at rates of 10 percent,15 percent,25 percent,28 percent,33 percent and 35 percent will expire,and revert to the pre-Bush era five income brackets taxed at rates of 15 percent,28 percent,31 percent,36 percent and 39.6 percent. Without some reconciliation in Congress,everyone,even those at poverty level,will see their taxes increase.

The marriage tax penalty will return. The tax code,before the 2001 EGTRA (Economic Growth and Tax Relief Reconciliation Act),required a husband and wife to pay more in taxes when they filed jointly than they would as single taxpayers. This will expire the end of the year as well. According to calculations from the tax publisher CCH,the marriage tax penalty translates to a nearly 17% increase in taxes for those married couples who file jointly,regardless of bracket.

READ MORE...

An election for President and Commander in Chief of the Military must strive to be above reproach. Our public institutions must give the public confidence that a presidential candidate has complied with the election process that is prescribed by our Constitution and laws. It is only after a presidential candidate satisfies the rules of such a process that he/she can expect members of the public, regardless of their party affiliations, to give him/her the respect that the Office of President so much deserves.

An election for President and Commander in Chief of the Military must strive to be above reproach. Our public institutions must give the public confidence that a presidential candidate has complied with the election process that is prescribed by our Constitution and laws. It is only after a presidential candidate satisfies the rules of such a process that he/she can expect members of the public, regardless of their party affiliations, to give him/her the respect that the Office of President so much deserves.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.